KNOW

FIRST.

MOVE FIRST.

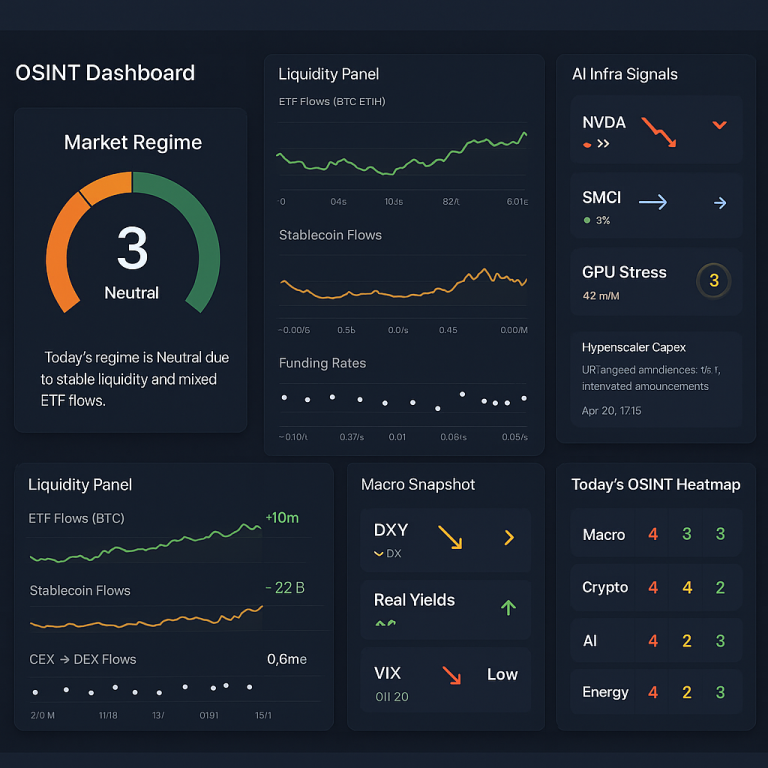

OSINT-driven intelligence on capital flows, AI infrastructure

and structural regime shifts.

WHAT ACTUALLY MOVES MARKETS

CAPITAL FLOWS

- Sovereign accumulation- - Shadow liquidity cycles

- - Institutional positioning

- Sovereign accumulation

Regulation Signals

- Structural policy shifts

- Jurisdictional arbitrage

- Trade regime transitions

- Structural policy shifts

- Jurisdictional arbitrage

- Trade regime transitions

AI INFRASTRUCTURE

- GPU supply chain OSINT

- Power grid constraints

- Hyperscale CapEx regimes

- GPU supply chain OSINT

- Power grid constraints

- Hyperscale CapEx regimes

LATEST SIGNALS

“Kalshi Prediction Market Controversy Drives Crypto and Macro Forecasting Shifts Amid Regulatory Scrutiny”

Kalshi Prediction Market Controversy and Regulatory Developments Impacting Crypto and Macro Forecasting Over the past 48 hours, increased public backlash and regulatory scrutiny surrounding

Gasoline Price Surge in US Signals Macro Pressure on Energy Infrastructure

Gasoline Price Surge in US Reflects Infrastructure and Supply Constraints Amid Geopolitical Tensions Over the past 72 hours, US gasoline prices have increased sharply,

Consumer Discretionary Sector Signal: Burger King’s Premium Reformulation Sparks Inflation Alignment

Consumer Discretionary Sector Signal: Burger King’s Whopper Reformulation and Inflation Dynamics Over the past 72 hours, OSINT indicates that Burger King announced a product

QSR Reformulation Unlinked to Macro, AI, or Green Energy Trends

Consumer Product Reformulation in QSR Sector Does Not Impact Macro, AI, or Green Energy Signals Over the past 72 hours, no relevant macroeconomic, AI

Nvidia Earnings Surge Indicates AI Infrastructure Ascendancy Amid Data Center Growth

Nvidia Earnings and Guidance Signal Strong Growth in AI Infrastructure and Data Center Markets Recent OSINT indicates Nvidia’s Q4 FY2026 earnings release and positive

China’s Crypto Ban Shapes Global Liquidity Dynamics and Stablecoin Markets

China Crypto Ban and RWA Tokenization Rules Impacting Global Liquidity and Stablecoin Markets Recent regulatory updates from China, including the reaffirmation of a crypto

MARKETS PRICE NARRATIVES.

INSTITUTIONS

PRICE CYCLES.

Doberman VC maps the divergence between sentiment and capital

deployment.

DOBERMAN INTELLIGENCE SYSTEM

The institutional engine for OSINT-based capital flow detection and regime mapping.

- High-fidelity signal aggregation

- Structural anomaly detection

- Sovereign flow visualization