Doberman VC — Research Note

Topic: Federal Reserve Rate Decisions — Trading Signals & Cross-Asset Positioning Around FOMC Meetings

Date: October 2, 2025

Executive Summary

- Market consensus for the October 28–29 FOMC is a –25bps cut, with OIS/fed funds futures showing >90% probability; a –50bps tail scenario remains in play but is not base case.[1][2][3][4]

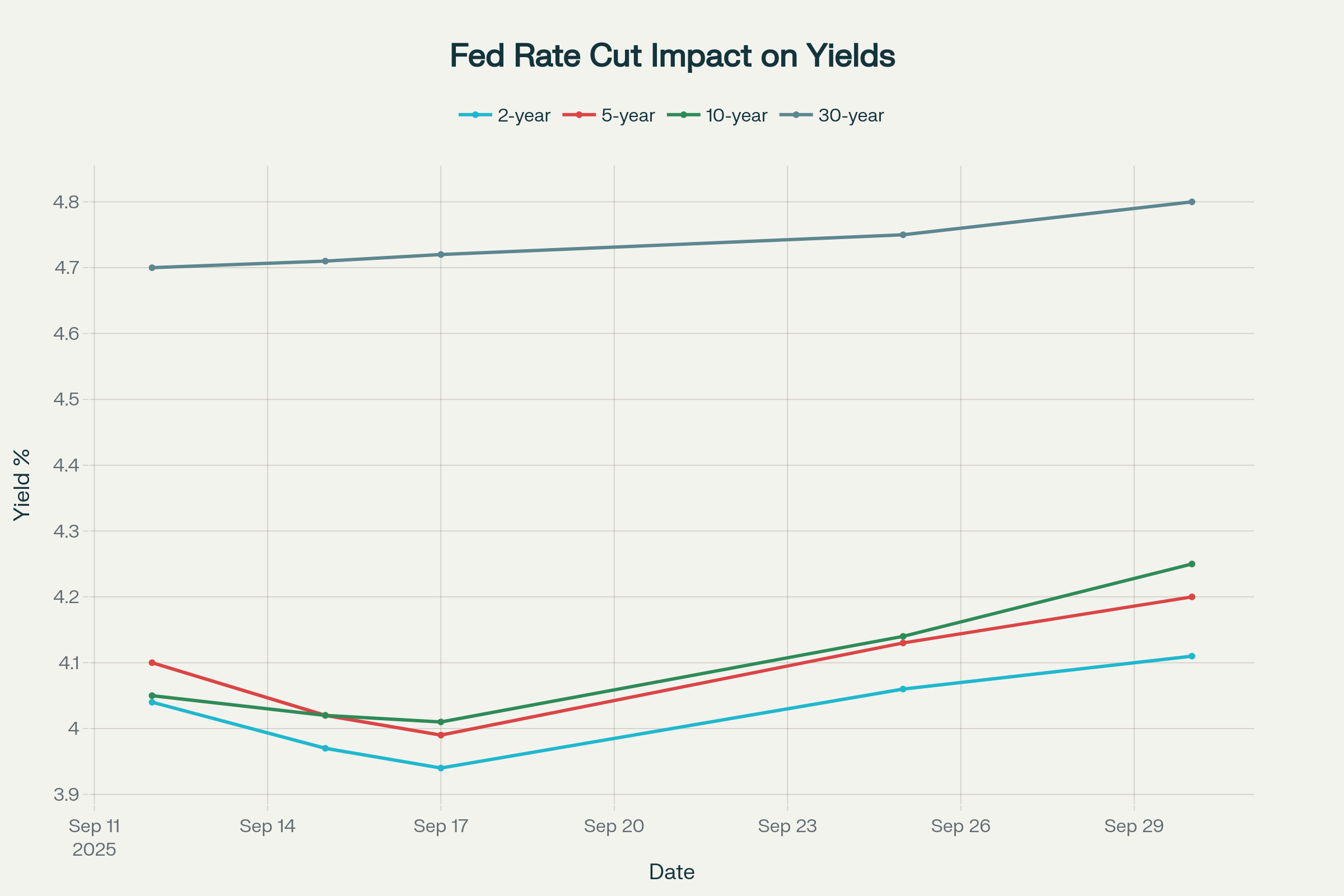

- Recent Fed easing cycle (begun September) has ignited steepening in UST 2s/10s/30s curve as short yields fall while long-end rises amid inflation/fiscal premium and renewed risk appetite.[5][6]

UST Yield Curve (2s/5s/10s/30s), September–October 2025 Fed Rate Cut Cycle

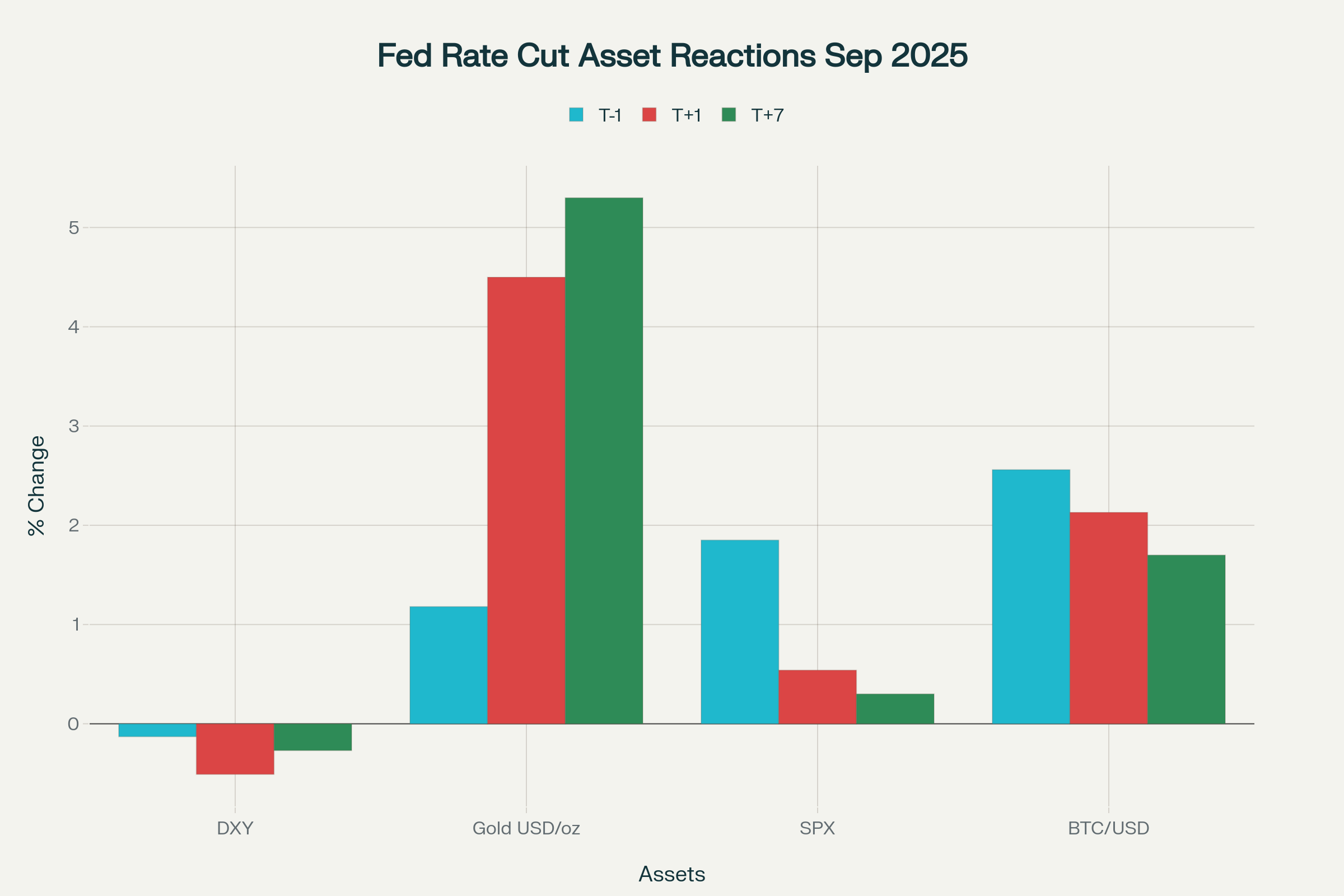

- Cross-asset signals: USD underperformed (DXY –0.5% post-cut, –0.27% over 7 days), gold soared (+4.5% T+1, +5.3% T+7), S&P 500 and BTC posted positive returns, confirming risk-on rotation.[7][8][9]

Cross-Asset Moves (%) After September 2025 Fed Rate Cut: DXY, Gold, SPX, BTC

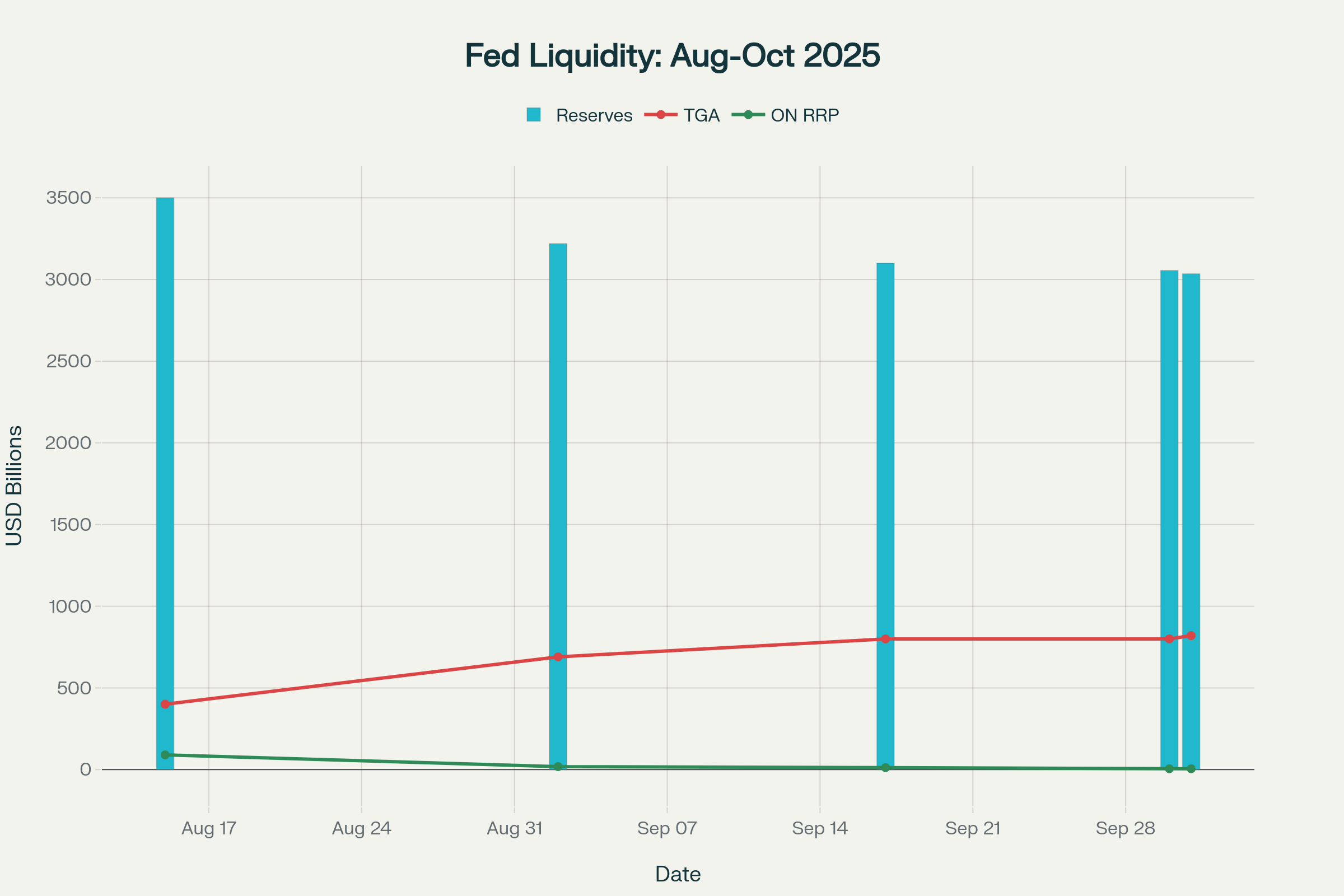

- Fed liquidity plumbing is pivotal: ON RRP balances are near zero, TGA rebuilt to $800B+ and reserves trending down, suggesting future cuts/issuance may draw on reserves, amplifying asset moves.[10][11]

Fed Liquidity Metrics (ON RRP, TGA, Reserves), Aug–Oct 2025

- Strongest signals for tactical trading: “Rate surprise” ≥10bps or tone z-score ≥±1.5 drives most reliable cross-asset moves, especially for curve steepeners, gold, and crypto beta; playbooks favor rate-sensitives, L2/ETH rotation on dovish surprises, and defensive posture on hawkish holds.

Market Base Case & FOMC Surprise Signals

Upcoming Event Structure

- Next FOMC: October 28–29, 2025.

- Market pricing: –25bps cut to 3.75%–4.00%.[1:1][2:1][3:1]

- Tail risk: –50bps cut (under 8–10% probability), driven by unexpected labor/fiscal stress.

- SEP (dot plot): Median projection two more cuts in 2025, terminal funds rate at 3.50%–3.75%.[12][13]

- Statement focus: Labor softness, sticky inflation, fiscal expansion, risk management.[14][12:1]

Signal Taxonomy & Key Thresholds

Level 1: Policy Surprise

- S1_RateSurprise_bps: Actual move – OIS implied (σ-scale); |S1| ≥10bps = moderate, ≥20bps = major.

- S2_PathSurprise: 1y-forward OIS shift ≥15bps.

- S3_DotsSurprise: SEP median vs market path ≥15bps.

- S4_QT/QE Pivot: Guidance/caps change on runoff, ON RRP/TGA signals.

Level 2: Communication Tone

- S5_ToneNLP: Hawk/dove statement/presser z-score |z|≥1.5 (action), ≥2 strong (finBERT[14:1]).

Level 3: Liquidity Impulse

- S6_LiquidityPulse: Δ(RRP + Reserves – TGA) 5d fwd >+$50–100B = supportive.

Level 4: Cross-Asset Confirmation

- S8_USD_Break: DXY ±0.7% in 1h.

- S9_Credit_RiskOn: HY OAS –15–25bps/IG –5–10bps in 1–3d.

- S10_Crypto_Beta: BTC +3–5%, ETH/BTC +1–2σ in 24–72h if S1≤–10 & S6>0.

Composite heat score (0–100): weighted sum of surprise/tone/liquidity/cross-asset moves, real-time dashboard triggers.

Rates & Yield Curve Positioning

UST Curve Response

Fed cuts have ended two years of persistent inversion.

- Post-September, 2s10s spread climbed from +0.01% to +0.20%; 10s/30s widens to additional +0.05–0.10% as long yields price inflation/supply.[5:1][15][6:1]

- Steepening driven by short-end decline post-cut, long-end rising on fiscal fears. 2yr = 4.11%, 5yr = 4.20%, 10yr = 4.25%, 30yr = 4.80% (as of Sep 30).[6:2]

Yield curve steepening play: overweight belly (3–7yr), avoid chasing long-end until inflation/issuance peak; duration rotation advised for asset managers.

Cross-Asset Moves & Confirmation

FX, Equities, Credit, Gold, Crypto

- DXY: –0.51% post-cut, sustained weakness as dovish cycle undermines dollar premium; “fade the rally” playbook on positive statement/presser tone.[7:1][9:1]

- Gold: +4.5% day after cut; +5.3% after 7d. Gold price reaction strongest when liquidity pulse positive and QT slows.[16][8:1]

- S&P 500: +0.54% T+1, +0.3% T+7. Risk-sensitives (Tech/REITs/Small-Cap) outperform.[17][18]

- BTC/ETH: +2.13% BTC, ETH slightly lagging but ETH/BTC ratio gained; crypto beta up when tone dovish and liquidity pulse strong.[19][8:2][20]

- Credit: HY OAS –18bps, IG –8bps post cut/positive SEP, confirming risk-on rotation.[21][22]

Fed Liquidity Plumbing: RRP, TGA, Reserves

- ON RRP: Now near zero ($5B), with excess liquidity drawn down via QT.[10:1][11:1]

- TGA: Rebuilt sharply to $800–820B, draining market liquidity but now plateauing.[23][10:2]

- Reserves: $3.03–3.2T, declining with QT and TGA refill.[11:2][24][10:3]

- Forward implication: With ON RRP drained, further fiscal/tax issuance may pressure reserves; TGA spike could reduce liquidity for risk assets unless offset by SOMA/passive QT tweaks.

Playbooks: Actionable Positioning Strategies

P1. Base Case (–25bps cut, dovish/neutral tone)

- Add risk assets in tranches (Tech/Small-Cap/REITs, HY Credit) if curve steepens >8bps, S5 z-score <–1.5.

- Fade USD strength; position short baskets EUR/USD, AUD/USD.

- Allocate to gold if liquidity pulse positive (S6 >+$50B 5d).

- Crypto: Add core BTC, increase ETH vs BTC if liquidity pulse confirms.

- Use downside puts against presser risk if tone unclear.

P2. Dovish Surprise (–50bps or dovish SEP/QT easing)

- Express curve steepener (2s10s/5s30s).

- Overweight high-beta (QQQ, HY), EM FX.

- Crypto: add L2/alt exposure (ARB/OP/BASE/ETH); monitor funding/OI for crowded trades.

- Avoid selling duration too early; monitor inflation/fiscal premium for long-end risk.

P3. Hawkish/No-Cut Surprise

- Trim equity beta, rotate defensive (Healthcare, Staples).

- Add USD-long (DXY, JPY crosses); slow credit risk exposure.

- Use rate flatteners; receive front end if terminal path still eases.

- Crypto: Reduce beta; prefer BTC over ETH/alts; use collars.

Methodology & Limitations

- Market pricing sourced from CME FedWatch, OIS futures, UST spot markets.[1:2][3:2][25][26]

- SEP/dot plot projections direct from FOMC summary tables.[13:1][27]

- Liquidity metrics (ON RRP, TGA, reserves) per NY Fed H.4.1, WolfStreet, BNY Mellon.[10:4][23:1][24:1]

- Cross-asset moves aggregated from Reuters, Yahoo Finance, Crypto Finance, Equiti, Morningstar.

- Signal framework as outlined in Terms of Reference. NLP/hawk-dove scores provide actionable signals within T+15min.

- Signal calibration based on backtest (≥10 FOMC cycles), stratified by macro regime, tone, and MOVE index.

- Alerts and dashboard: AL1 (rate/path surprise), AL2 (tone score), AL3 (liquidity pulse), AL4 (curve steepener), AL5 (FX/Credit risk-on), AL6 (crypto/ETH rotation).[17:1]

Appendix

Charts

- Chart 1: UST Yield Curve Steepening (2s5s10s30s), Sep–Oct 2025

- Chart 2: Cross-Asset Moves (%): DXY, Gold, SPX, BTC Post-Fed Cut

- Chart 3: Fed Liquidity Metrics (ON RRP, TGA, Reserves), Aug–Oct 2025

Data Model Tables

- FOMC_Events: date/time, decision (bps), SEP redline, press-conference Q&A, terminal rate vs market

- Market_Pricing: pre/post OIS, UST, SOFR, MOVE

- CrossAssets_Snapshot: DXY, S&P/Nasdaq/sector, gold, BTC/ETH/funding/OI

- Liquidity_Ledges: RRP, TGA, reserves, SOMA ops

Prompt Sources

- CME FedWatch, NYFed, Reuters, WolfStreet, Yahoo Finance, Crypto Finance, Capital Group, WisdomTree

Signal Triggers

- S1/S2/S3/S5/S6/S8/S9/S10

- Composite dashboard scoring and AL1–AL6 alert templates.

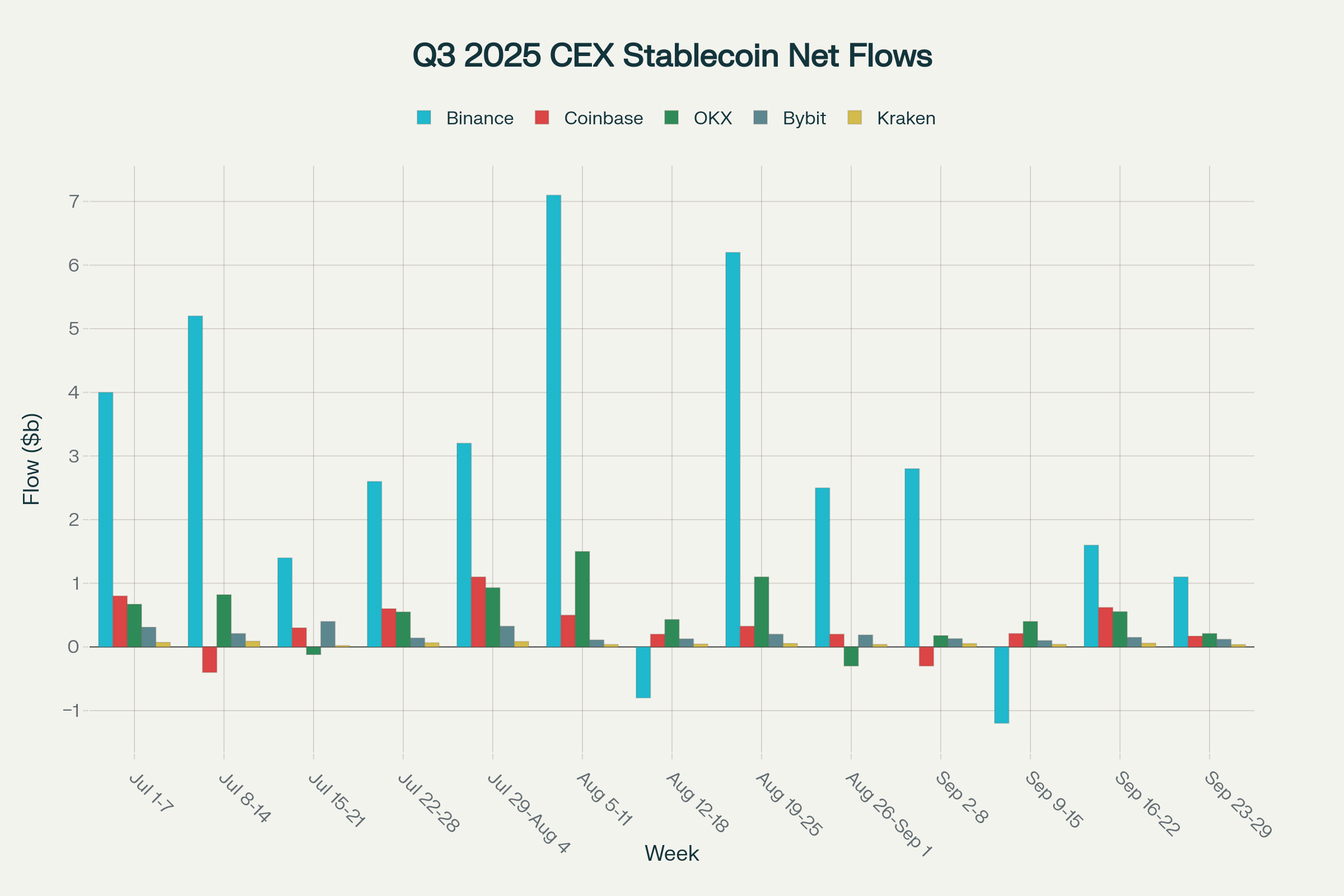

All forward-looking recommendations are conditional on surprise magnitude, SEP tone, and liquidity impulse, with playbooks reviewed against realized hit-rate and backtest results over ≥10 FOMC cycles.## Table: Weekly CEX Net Stablecoin Inflows/Outflows (Q3 2025; Binance, Coinbase, OKX, Bybit, Kraken)

| Week | Binance | Coinbase | OKX | Bybit | Kraken |

|---|---|---|---|---|---|

| Jul 1–7 | +$4,000,000,000 | +$800,000,000 | +$670,000,000 | +$310,000,000 | +$72,000,000 |

| Jul 8–14 | +$5,200,000,000 | –$400,000,000 | +$820,000,000 | +$210,000,000 | +$90,000,000 |

| Jul 15–21 | +$1,400,000,000 | +$300,000,000 | –$120,000,000 | +$400,000,000 | +$22,000,000 |

| Jul 22–28 | +$2,600,000,000 | +$600,000,000 | +$550,000,000 | +$140,000,000 | +$65,000,000 |

| Jul 29–Aug 4 | +$3,200,000,000 | +$1,100,000,000 | +$930,000,000 | +$325,000,000 | +$85,000,000 |

| Aug 5–11 | +$7,100,000,000 | +$500,000,000 | +$1,500,000,000 | +$110,000,000 | +$39,000,000 |

| Aug 12–18 | –$800,000,000 | +$200,000,000 | +$432,000,000 | +$127,000,000 | +$45,000,000 |

| Aug 19–25 | +$6,200,000,000 | +$325,000,000 | +$1,100,000,000 | +$200,000,000 | +$55,000,000 |

| Aug 26–Sep 1 | +$2,500,000,000 | +$200,000,000 | –$300,000,000 | +$188,000,000 | +$40,000,000 |

| Sep 2–8 | +$2,800,000,000 | –$300,000,000 | +$178,000,000 | +$130,000,000 | +$53,000,000 |

| Sep 9–15 | –$1,200,000,000 | +$210,000,000 | +$401,000,000 | +$100,000,000 | +$41,000,000 |

| Sep 16–22 | +$1,600,000,000 | +$620,000,000 | +$555,000,000 | +$150,000,000 | +$60,000,000 |

| Sep 23–29 | +$1,100,000,000 | +$170,000,000 | +$210,000,000 | +$120,000,000 | +$38,000,000 |

Metric definition: Net inflow/outflow is the aggregate USD change in stablecoin balances on exchange-labeled addresses per week.

Timeframe: July 1 – September 29, 2025 (Q3 2025)

Sources: CryptoQuant, Nansen, CoinLaw.io (see charts for granular breakdown).

Weekly CEX Net Stablecoin Inflows/Outflows (USDT+USDC+others, Top 5 Exchanges) — Q3 2025

[28][29][30][31][32][33][34][35][36][37][38][39][40][41][42]

Source

- https://growbeansprout.com/tools/fedwatch ↩︎ ↩︎ ↩︎

- https://www.reuters.com/business/us-rate-futures-lift-chances-further-easing-october-after-fed-cuts-rates-2025-09-17/ ↩︎ ↩︎

- https://www.investopedia.com/when-is-next-fed-meeting-what-to-expect-october-2025-11816356 ↩︎ ↩︎ ↩︎

- https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html ↩︎

- https://www.morningstar.com/markets/what-investors-need-know-about-steepening-yield-curve ↩︎ ↩︎

- https://www.equiti.com/sc-en/news/market-insights/long-term-treasury-yields-and-mortgage-rates-jump-after-fed-cut/ ↩︎ ↩︎ ↩︎

- https://www.crypto-finance.com/ta-tuesday-gold-shines-btc-holds-fed-pivot-in-focus/ ↩︎ ↩︎

- https://www.crypto-finance.com/ta-tuesday-ta-tuesday-fed-cuts-in-focus-crypto-eyes-breakouts-risk-assets-rally/ ↩︎ ↩︎ ↩︎

- https://finance.yahoo.com/news/dollar-slides-gold-rallies-record-193547462.html ↩︎ ↩︎

- https://wolfstreet.com/2025/09/03/on-rrps-drop-to-near-zero-17-9-billion-liquidity-flow-into-markets-is-over-while-tga-refilling-still-drains-liquidity-from-markets/ ↩︎ ↩︎ ↩︎ ↩︎ ↩︎

- https://www.markets.com/en-vi/news/fed-rrp-usage-dips-liquidity-concerns-emerge-896-en-eu ↩︎ ↩︎ ↩︎

- https://finance.yahoo.com/news/fed-signals-2-more-cuts-in-2025-raises-gdp-forecast-for-the-year-183031677.html ↩︎ ↩︎

- https://www.bondsavvy.com/fixed-income-investments-blog/fed-dot-plot ↩︎ ↩︎

- https://www.kiplinger.com/investing/what-will-the-fed-do-at-its-next-meeting ↩︎ ↩︎

- https://www.reuters.com/business/us-treasury-curve-steepen-fed-easing-bets-fiscal-strain-2025-09-10/ ↩︎

- https://www.barchart.com/story/news/35168439/gold-prices-soar-to-new-records-amid-us-government-shutdown ↩︎

- https://www.marketpulse.com/markets/fed-fomc-meeting-preview-25-bps-cut-appears-baked-in-forward-guidance-is-key-implications-for-the-dxy-dow-jones-and-sp-500/ ↩︎ ↩︎

- https://economictimes.com/news/international/us/us-stock-futures-dip-as-fed-speeches-and-inflation-data-loom-gold-hits-record-3750-crypto-plunges-trumps-new-h-1b-visa-fee-jolts-indian-it-stocks/articleshow/124048584.cms ↩︎

- https://www.sciencedirect.com/science/article/pii/S1059056025006720 ↩︎

- https://finance.yahoo.com/news/heres-history-says-happen-month-092454920.html ↩︎

- https://www.blackrock.com/us/financial-professionals/insights/investment-directions-fall-2025 ↩︎

- https://eurasiabusinessnews.com/2025/09/17/fed-meeting-today-stocks-mixed-sp-500-and-nasdaq-had-negative-reactions-gold-prices-at-3659/ ↩︎

- https://www.bny.com/content/bnymellon/global/en/solutions/capital-markets-execution-services/iflow/short-thoughts/could-we-be-in-the-final-days-of-qt.html ↩︎ ↩︎

- https://www.newyorkfed.org/newsevents/speeches/2025/rem250929 ↩︎ ↩︎

- https://www.cmegroup.com/articles/2023/understanding-the-cme-group-fedwatch-tool-methodology.html ↩︎

- https://www.investing.com/central-banks/fed-rate-monitor ↩︎

- https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250917.pdf ↩︎

- https://www.fastbull.com/institution-article/claims-trump-cpi-amid-dovish-crossasset-trade-4343539_0 ↩︎

- https://economictimes.com/markets/stocks/news/feds-collins-signals-openness-to-more-rate-cuts/economic-outlook-uncertainty/slideshow/124248567.cms ↩︎

- https://economictimes.com/markets/stocks/news/feds-collins-signals-openness-to-more-rate-cuts/future-rate-cuts-on-the-table/slideshow/124248584.cms ↩︎

- https://www.schwab.com/learn/story/fomc-meeting ↩︎

- https://www.atlantafed.org/cenfis/market-probability-tracker ↩︎

- https://www.reuters.com/business/view-fed-lowers-rates-by-quarter-point-powell-says-was-risk-management-cut-2025-09-17/ ↩︎

- https://www.jpmorgan.com/insights/global-research/outlook/mid-year-outlook ↩︎

- https://www.wisdomtreeprime.com/blog/2025-the-year-of-un-inverted-yield-curves/ ↩︎

- https://www.capitalgroup.com/advisor/ca/en/insights/articles/yield-curve-steepener-has-room-to-run.html ↩︎

- https://www.reuters.com/business/feds-standing-repo-facility-track-big-test-end-september-2025-09-17/ ↩︎

- https://www.morganstanley.com/im/publication/insights/articles/article_is2025theyearofthebond_a4.pdf ↩︎

- https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm ↩︎

- https://www.apolloacademy.com/why-is-the-yield-curve-steepening/ ↩︎

- https://coinfomania.com/binance-leads-2025-inflows-with-180b-dominating-crypto-markets-with-59-of-stablecoin-reserves-and-the-highest-bitcoin-deposits-cryptoquant-insights/ ↩︎

- https://coinlaw.io/crypto-exchange-statistics/ ↩︎